What The General Election Means For Your Mortgage

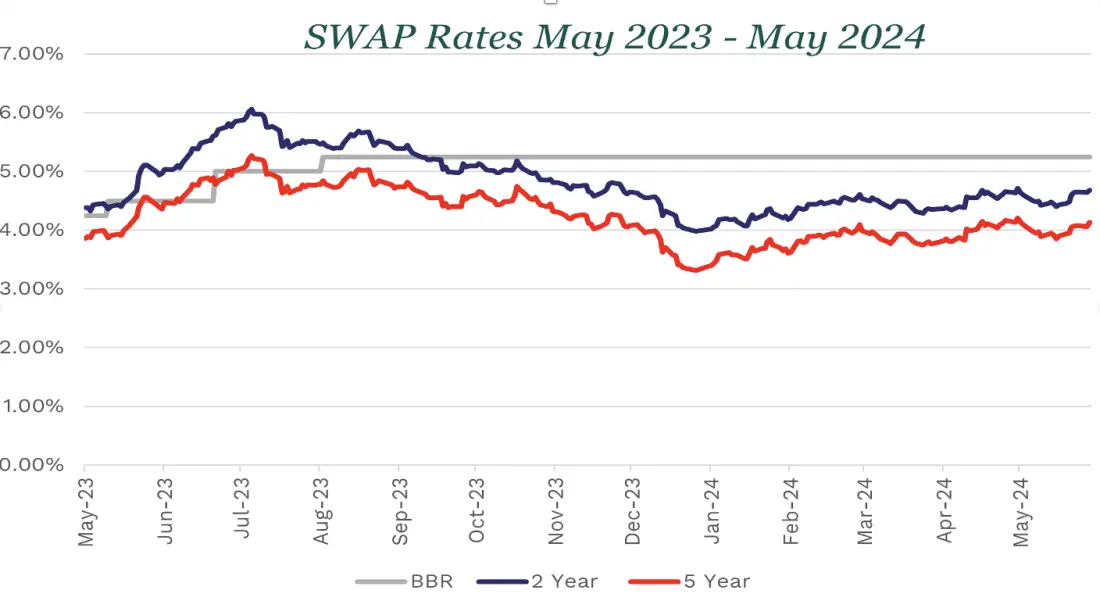

Swap rates (the rates which influence mortgage interest pricing for most lenders) have moved regularly since January 2024. The good news is that it is less often than in May 2023. Due to the general election on July 4th, US inflation, and geopolitical events has affected the market.

As we are only 4 weeks away from the election, we have seen evidence that SWAP rates have been increasing slightly. Unfortunately, the announcement of the general election had an adverse response from the money markets.

The markets are anticipating what each Party’s manifestos will be and how they will impact on the UK economy. In the meantime, there will be a spell of uncertainty. SWAP rates are expected to not continue to rise, so this will not have an impact on mortgage interest rates should remain mostly firm.

It is widely predicted that Bank of England Base Rate (BBR) would decrease in June; although it is the norm (although not the rule) to keep the BBR at its current level throughout a general election period. Experts still forecast the first 0.25% drop this summer, however August may be more practical than June, with mid-September more logical if the economy is still adjusting to the election result.